Freehold vs Leasehold Property: What is Better

03, November 2025

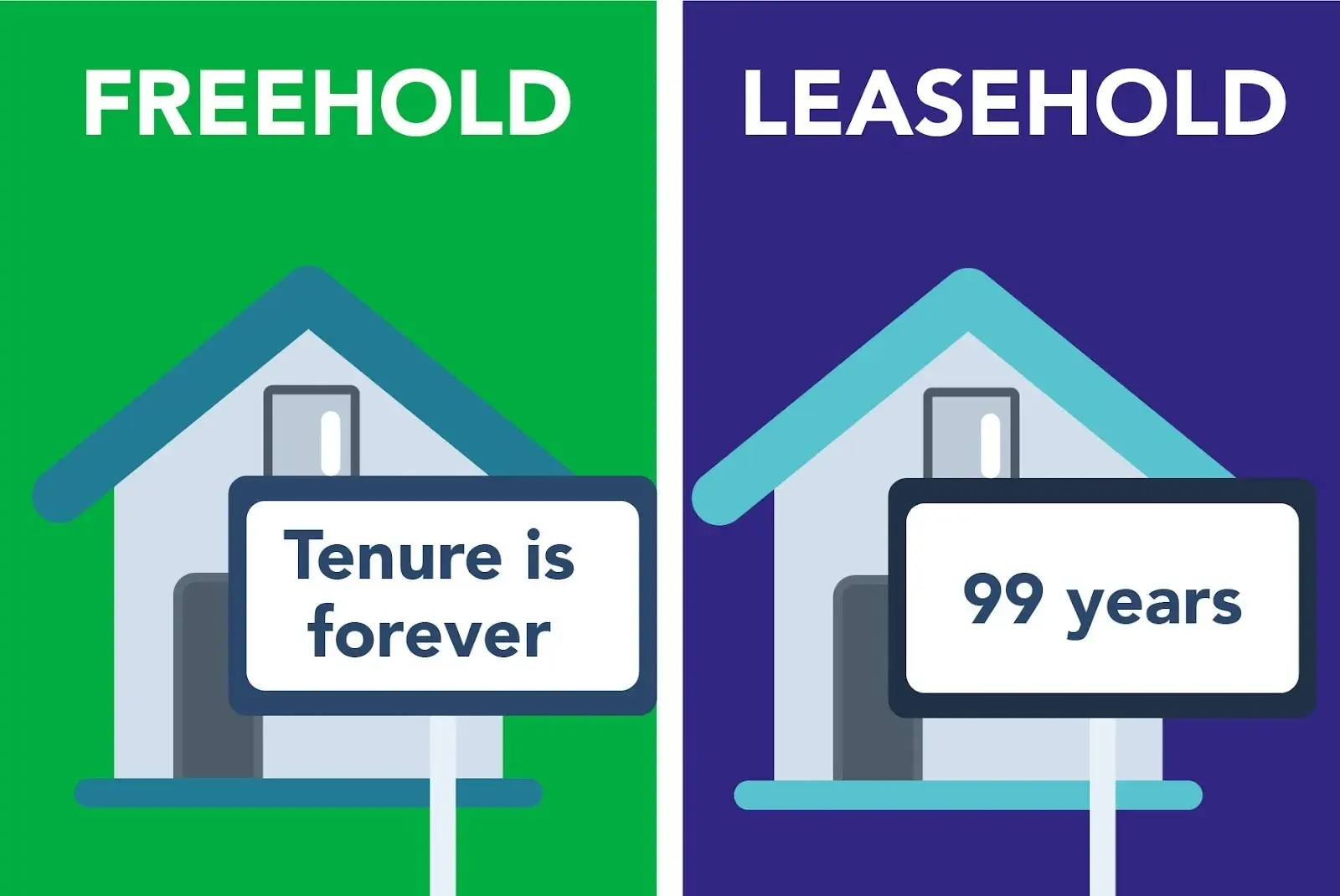

When it comes to buying property in India—whether it’s a cozy apartment, a residential plot, or a commercial space—one key detail that often confuses buyers is the type of ownership: Freehold or Leasehold.

What Is a Freehold Property?

A Freehold property is one where the owner has complete ownership of both the land and the structure built on it. Once you purchase a freehold property, it’s yours for life—no lease, no rent, no renewal terms.

You can sell, lease, mortgage, or pass it on to your heirs without needing any approval from a government body or development authority (except the usual legal process).

In simple words:

Freehold means “It’s all yours—forever!”

Key Features of Freehold Property

- Full ownership of land and building.

- No lease agreements or renewal clauses.

- Freedom to make modifications (subject to local regulations).

- Can be sold or transferred easily.

- Higher market value and appreciation potential.

What Is a Leasehold Property?

A Leasehold property means you own the building or unit, but the land is owned by the government or a development authority, such as Haryana Urban Development Authority (HUDA) or Delhi Development Authority (DDA).

In this case, the property is leased to you for a fixed period, usually 30, 60, or 99 years. You pay a lease premium and sometimes a small annual ground rent.

Once the lease period ends, the ownership reverts to the lessor (the authority or landowner), unless renewed by paying additional charges.

In simple words:

Leasehold means “You own it for now, not forever.”

Key Features of Leasehold Property:

- Land ownership remains with the government/authority.

- Property is leased for a fixed duration (30–99 years).

- Renewal required after lease expiry.

- Sale or transfer needs permission from the authority.

- Slightly lower upfront cost compared to freehold.

Cost Factor: Why Leasehold Properties Are Cheaper

One big reason why some buyers opt for leasehold properties is the price difference. Leasehold plots or apartments are generally 10–20% cheaper than freehold ones in the same area.

However, the lower price comes with a trade-off:

- You might face difficulties when reselling.

- Banks may hesitate to provide long-term home loans.

- Renewal costs at the end of the lease term can be significant.

So while it looks cheaper initially, leasehold properties can end up being costlier in the long run.

Financing & Resale Challenges

When applying for a home loan, banks prefer freehold properties because they carry less legal risk. For leasehold properties, lenders assess the remaining lease duration carefully.

If the remaining lease period is less than 30 years, many banks either reduce the loan tenure or reject the application altogether.

Similarly, reselling a leasehold property can take longer because potential buyers and banks both evaluate the lease conditions before committing.

Conversion from Leasehold to Freehold

Here’s some good news — in many states, leasehold properties can be converted into freehold.

For example:

- DDA and HUDA allow leasehold-to-freehold conversion by paying a conversion fee, submitting required documents, and clearing dues.

- Once converted, you get full ownership rights, making it easier to sell or mortgage.

- Full ownership rights.

- Easy to sell, mortgage, or modify.

- High resale value and appreciation.

- Ideal for long-term investment and inheritance.

- Higher purchase price.

- Availability can be limited in prime city areas.

- Lower initial cost.

- Suitable for those with short- to mid-term property goals.

- Some government projects are available only on leasehold basis.

- Ownership expires after lease term.

- Renewal and resale can be complicated.

- Limited flexibility for modifications or transfers.

- Banks may hesitate to offer full-term loans.

- Build homes as per their own design preferences.

- Enjoy complete ownership.

- Benefit from growing infrastructure and appreciation potential.

However, the conversion process can be time-consuming and may involve bureaucratic delays. Still, it’s a worthwhile investment if you plan to hold the property long-term.

Pros & Cons at a Glance:

Freehold Property — Pros

Freehold Property — Cons

Leasehold Property — Pros

Leasehold Property — Cons

Why Freehold Is Preferred in Modern Developments

Developers today, especially in emerging locations like Pataudi, Sohna, and New Gurgaon, are increasingly launching freehold plotted developments under schemes like Deen Dayal Jan Awas Yojna (DDJAY).

These projects give buyers the freedom to:

For example, a project like Spiti Heritage Homes, being DDJAY-approved, offers freehold plots with all modern amenities—ensuring you’re not just buying land but investing in lasting freedom and security.

Final Thoughts:

When buying a property, understanding whether it’s freehold or leasehold is crucial. A freehold property gives you complete ownership of both the land and the building, offering long-term security, flexibility, and higher resale value. In contrast, a leasehold property means you own the property for a fixed period, while the land belongs to the government or developer, making it more affordable but with limited rights. Simply put, freehold is ideal for long-term investment and stability, while leasehold suits those seeking affordability or short-term use.

When choosing between Freehold vs Leasehold property, think beyond just price. Consider your future plans, financial goals, and flexibility needs.

If you are looking for long-term ownership, easier financing, and hassle-free resale — Freehold is undoubtedly the better choice. But if you want to enter the property market at a lower price point and don’t mind renewal conditions, Leasehold can still be a viable short-term option.